Credit spreads are a popular options trading strategy used to generate income in the Nifty Option Chain market. By implementing credit spreads, traders can take advantage of the time decay of options contracts and capitalize on the range-bound nature of the market. In this article, we will explore how credit spreads can be used for income generation in the Nifty Option Chain market.

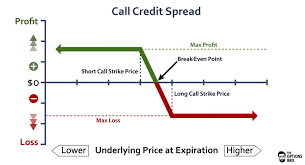

Understanding Credit Spreads: A credit spread involves simultaneously selling an option at a higher strike price and buying an option at a lower strike price within the same expiration cycle. Check more on how to make demat account? The premium received from selling the higher strike option is higher than the premium paid for buying the lower strike option, resulting in a net credit to the trader’s account. This net credit represents the income generated from the credit spread.

Types of Credit Spreads: In the Nifty Option Chain market, there are two common types of credit spreads: the bear call spread and the bull put spread. The bear call spread involves selling a call option at a higher strike price and buying a call option at a lower strike price. The bull put spread, on the other hand, involves selling a put option at a higher strike price and buying a put option at a lower strike price.

Income Generation: The primary objective of credit spreads is to generate income. By selling options with a higher strike price and buying options with a lower strike price, traders receive a net credit upfront. This credit represents their potential profit, which they can keep if the options expire worthless. Check more on how to make demat account? As time passes and the options approach expiration, the value of the credit spread decreases due to time decay, allowing traders to retain a portion of the initial credit as income.

Range-Bound Market: Credit spreads are particularly effective in range-bound markets, where the price of the underlying asset, in this case, the Nifty Index, remains within a specific range. In such markets, the options sold in the credit spread are less likely to be exercised, allowing traders to retain the credit as income. By selecting strike prices that are above or below the expected range, traders can increase the probability of the options expiring worthless.

Risk Management: While credit spreads offer income generation potential, it is crucial to implement risk management strategies. Traders should determine their risk tolerance and set appropriate stop-loss orders. Check more on how to make demat account? Additionally, it is important to closely monitor the market and adjust the positions if the price of the underlying asset breaks out of the expected range. Proper risk management is essential to protect capital and mitigate potential losses.

Time Decay Advantage: One of the key benefits of credit spreads is the advantage of time decay. As options approach expiration, their value decreases due to time decay. Traders who have sold options in the credit spread can benefit from this time decay, as the value of the options they sold diminishes, allowing them to retain the initial credit as income.

TECHGUIDANCES

TECHGUIDANCES